Demand Transparency and Accountability

Tell your legislators to demand MassDOT pause the lease until the Senate review is complete.

What Happened

In September 2024, MassDOT launched a bidding process for 18 highway service plazas, many of which are located along the Massachusetts Turnpike.

Global Partners, a fourth-generation Massachusetts-based company, submitted a proposal that offered:

- $1.5 billion in GUARANTEED rent

- Partnership with local businesses like Commonwealth Kitchen that support diverse and local food entrepreneurs

- A $650 million investment in clean, modern facilities and sustainable operations1

MassDOT's own financial analyst, KPMG, concluded Global's proposal provided the best value for Massachusetts.

But in April 2025, days before the RFP deadline, there were last-minute rule changes that dramatically altered the process: extending the lease from 30 to 35 years, slashing insurance protections, and removing key financial safeguards, all benefiting private equity bidders.

In June 2025, despite concerns about transparency and with one-sided and skewed information, the MassDOT Board voted to award the contract to Applegreen, a foreign company majority owned by private-equity giant, Blackstone. The Board wasn't provided any information about Applegreen's real track record including cost overruns of more than 50-percent on a similar project in NY state2 or troubling wage disputes with critical travel plaza employees3. Just a week before the vote, some board members voiced unease4, yet the decision moved forward anyway without a full side-by-side review of both proposals.

Even more troubling, MassDOT’s Chief Development Officer and Chair of the Selection Committee presented misleading financial figures favoring Applegreen, leaving the public without a clear explanation of how the final decision was made. He failed to disclose that financial expert KPMG determined that Applegreen's terms "do not seem to meet MassDOT's stated goal of sustaining and potentially increasing the revenue source over the lease term." The same expert said Global's did.

July Update: The Public Demands Better

Momentum grew statewide in July as Massachusetts residents, elected officials, and media raised serious concerns about the flawed MassDOT lease process:

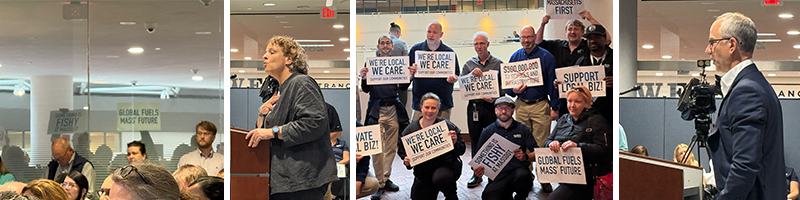

- More than 400 people rallied at the State House on July 29, calling for transparency, accountability, and oversight.

- Over 2,000 petition signatures were delivered to legislators, urging them to investigate how the decision was made.

- The Senate Committee on Post Audit and Oversight, chaired by Senator Mark Montigny, officially launched a probe into the process, requesting the full RFP, scoring criteria, and documentation of any lobbying activity.

- Lawmakers were given a deadline of August 8 to respond to oversight requests. This marks a critical first step toward protecting public trust and taxpayer dollars.

- Public awareness and media coverage expanded, spotlighting the nearly $900 million revenue gap between bids and the lack of secured financing by the winning bidder.5

This was a turning point. The July rally and Senate investigation marked the beginning of real responsible oversight. But with the MassDOT Board scheduled to meet again on September 17, and with insider reports that the deadline to sign is being rushed to mid-September, it’s critical to pause the lease signing until the investigation is complete.

The Debrief: What We Learned

On August 19, 2025, Global received a formal debrief by MassDOT representatives as required by the RFP guidelines. The entire presentation was scripted. It confirmed our deepest concerns:

- MassDOT broke its own rules. The head of the Selection Committee, Scott Bosworth, was absent in violation of the procedures manual. MassDOT claimed it had performed a "cost-benefit analysis" and determined Bosworth should not attend. They talked about other proposals also in violation of the manual and the RFP documents.

- Cherry-picked evidence. Notes from Bosworth were highlighted, while independent Subject Matter Expert (SME) findings were ignored.

- KPMG’s own review found: Applegreen’s terms “do not seem to meet MassDOT’s goal of sustaining revenue,” while Global’s terms “do.” These and other key conclusions from the SME’s were notably absent from the debrief script.

- Improper scoring. MassDOT openly admitted to scoring “post-revitalization CapEx”, a category never included in the original RFP. The RFP required only revitalization capital; however, after submissions closed, MassDOT slipped in this new criterion without providing guidance. This allowed Applegreen to inflate its numbers by counting routine maintenance as “capital investment.” The result was an inappropriate, apples-to-oranges comparison that unfairly skewed the Capital Investment scores.

MassDOT initially refused to release the debrief script to Global, only to reverse course and send it later. Then, less than 72 hours after our debrief, Applegreen launched a website parroting MassDOT’s exact script. That’s not a coincidence. It raises serious and troubling questions about back-channel coordination between the agency and the winning bidder in an effort to defend their decision and hide the full facts.

The Real Numbers: What MassDOT Isn’t Telling You

MassDOT awarded a 35-year contract that leaves nearly $1 billion in guaranteed revenue on the table.

- Global: $1.5 billion in GUARANTEED rent, protected by an unconditional parent guarantee. As The Boston Globe even noted, "No one disputes that the Global bid is potentially more lucrative....6"

- Applegreen: $623M - $994M in variable rent, contingent on fuel and concession sales. Rent wouldn’t even reach today’s levels until 2053, and it could drop even further. Their proposal explicitly states: “No property tax is payable by Applegreen. Where the Service Plazas are subject to property tax, the rental pass-up to MassDOT will need to be reduced by a corresponding amount.”

- The 18 plazas currently pay about $800,000 per year in property taxes. At a 3% annual increase, that totals $48.4M over 35 years, reducing Applegreen’s low-end rent from $623M to just $575M7.

- The Gap: At least $517M. At worst, nearly $900M.

On capital investment:

- Revitalization phase (apples-to-apples): Global = $322M; Applegreen = $383M. A difference of only about $61M, and both numbers were preliminary, non-binding estimates. In other words, when you look only at the revitalization capital the RFP actually required, the bids were nearly the same.

- Applegreen’s larger $750M “CapEx” figure was artificially inflated by including post-revitalization items like restroom refreshes, routine maintenance, and food service tenant buildouts that Global appropriately treated as operating expenses.

The truth: Massachusetts traded guaranteed rent for a deal that will certainly deliver $517 million less, and could short taxpayers by as much as $900 million. In exchange, the state accepted inflated capital assumptions that may never materialize.

Why It Matters

This isn’t just a contract; it affects every Massachusetts resident.

Massachusetts deserves a fair, open, and accountable process that puts public good first.

Our Vision for Massachusetts

Global Partners’ proposal would create world-class service plazas designed for Massachusetts travelers, families, and businesses.

Hear directly from our CEO and community partners about the future we’re still fighting for.

What Can You Do?

MassDOT is rushing to sign a 35-year lease that could cost Massachusetts taxpayers nearly $1 billion in guaranteed revenue, all while the Senate investigation is still underway.

We’re asking the Governor and the Legislature to demand:

- A full public release of all scoring and financial assumptions

- Answers on why nearly a billion dollars in guaranteed revenue was left behind

- Full transparency around all potential selection committee conflicts of interest

- A pause on finalizing the lease until the Senate Post Audit investigation is complete.

The MassDOT Board meets on September 17. Every signature, every message matters. The more voices the Governor and legislators hear, the harder it is to ignore the voices of the Commonwealth.

You can help:

One email today could help protect nearly $1 billion in taxpayer money.

Ask your legislators to demand MassDOT pause the lease until the Senate investigation is complete.

Who We Are

Global is a Massachusetts company with a 90-year legacy.

We live here. We work here. We hire here. We reinvest here, fueling schools, emergency services, and families.

We have a long history serving travelers along the Pike—but at most service areas, we are not the master tenant. That means we have limited ability to influence current site operations or invest in improvements. At four locations in Bridgewater, Beverly, and Barnstable, we stepped up as master tenant when others walked away. We kept the doors open, maintained service, and supported local jobs. We even offered to extend our leases so we could invest in upgrades, but MassDOT declined.

This RFP was a chance to deliver unmatched value for taxpayers, create good local jobs for our neighbors, and build a sustainable future for plazas that residents can be proud of — plazas that showcase the very best of Massachusetts, from our diverse products and local businesses to the foods and flavors that reflect the communities we serve.

Clean, modern facilities. Fresh, locally sourced food. Partnerships with beloved Massachusetts businesses. This was the future we proposed for the Mass Pike—and the future we’re still fighting for.

Make Your Voice Heard

The MassDOT Board meets on September 17. Legislators must tell MassDOT: Pause the lease until the Senate review is finished. Massachusetts deserves transparency, accountability, and a fair process

Notes & Sources

1MassDOT admitted during Global's August 19 debrief that it scored "post-revitalization" capital costs, even though the original RFP never required them and no guidance was given on what qualified. Applegreen counted routine maintenance, tenant buildouts, and refreshes as "capital," artificially inflating their $750M figure. Global correctly treated those items as repairs and maintenance operating expense and did not include buildout for food service subtenants which alone inflated Applegreen's capex by $72M. The only fair apples-to-apples comparison is the revitalization phase: Applegreen's $383M vs. Global's $322M. Both figures were preliminary, non-binding estimates. The real difference is in guaranteed rent: Global's $1.5B vs. Applegreen's $623M-$994M.

3WGAL News 8 (2025, August 13). Pennsylvania Turnpike rest plaza workers face wage cuts.

7Based on actual tax payments at 15 plazas plus estimates for Plymouth, Newton, and Lexington. Assumes 3% annual growth consistent with the rent escalator.